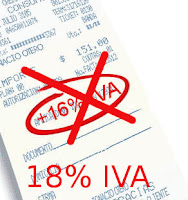

Last week the government announced an increase in IVA (sales tax). For many products it will now be 21%. The country is in a financial crisis and needs to somehow generate extra income, and yet at the same time as a result of the crisis the citizens do not have the money to pay the extra tax. The days ahead are going to be interesting.

Here is a glimpse at sales tax in Spain...

- Theater tickets, circus, bullfights, museums, attraction parks, etc... increased from 8% to 21% sales tax

- Health and Dental services... increased from 10% to 21%

- Hair Dresser or Manicurist... increased from 8% to 21%

- Clothes, footwear, tobacco, alcohol drinks... increased from 18% to 21%

- Flowers, bulbs, seeds.... increased from 10% to 21%

- Communications, real estate, and funeral fees... increased from 18% to 21%

- First Time Home Buyer Tax (previously if you were a first time home buyer you received a lower tax rate as an incentive to buy) - from 4% to 21%

Will be praying for you guys as you adjust to these new taxes. "Thankfully" the 27% VAT (Value Added Tax???) was in place when we arrived in Hungary, so it just comes with the territory. But sometimes if you look at a receipt and see how much tax you've added, its pretty frustrating.

ReplyDelete